Imagine a “subscription video profitability chart” where on the X-Axis we have Annual Spend and on the Y Axis we have Profitability. As spend increases, we see profit as a curve that reveals pockets that are profitable followed by pockets that are punishingly unprofitable. It is possible that you can have a profitable, targeted service at the $500MM or $1B spend level (maybe Starz is your candidate here). Obviously Netflix, with a $27B annual spend level, has found a profitable point way out on the right. Paramount is spending about $8B per year on Paramount+ and it is finding that this is “the gulf of death.” Warner Bros. Discovery is having a similar experience. This chart is an oversimplification (there is more to it than just spending) but its message is generally correct: from a scale point of view, there are locations on the chart that are bad, where you are too small (or too big). Sometimes you have to get bigger.

I have been saying (on X) that Paramount and WBD should tie the knot and now it appears they are at least talking about it. Let me explain why I think this is a good option for WBD, and the only good option for Paramount.

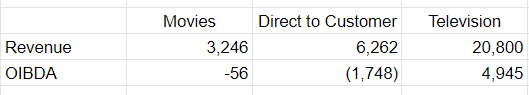

Paramount breaks its business into three divisions with the following ttm financial performance:

The Television division, including CBS and the cable networks, is declining as people cancel pay TV and shift viewership to streaming. Television revenues were down in Q3 7.7% YOY. (Note Paramount’s low measured viewership in the right column.)

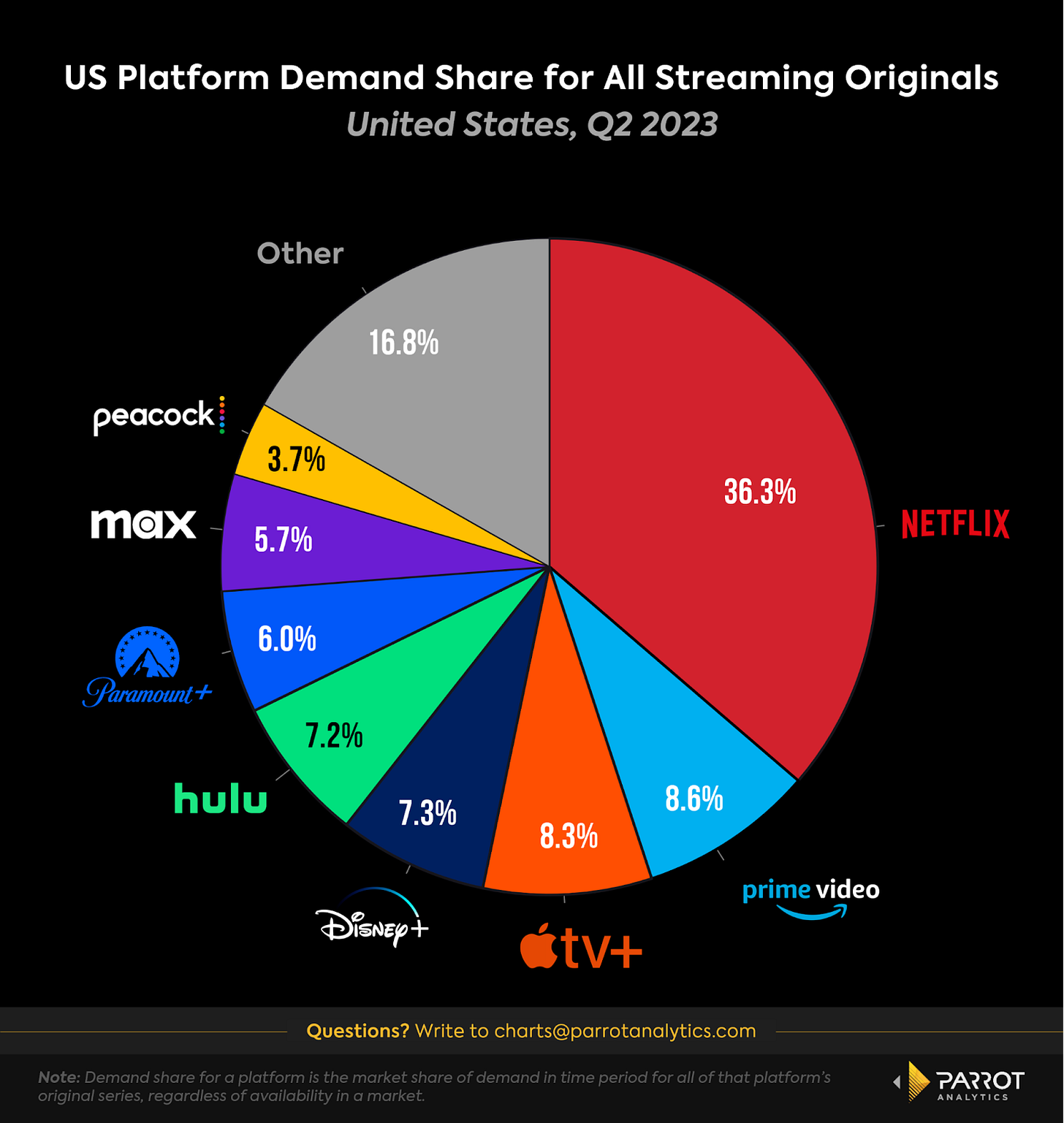

The goal is for streaming (“Direct to Customer”) to pick up the slack. Amongst US streaming services Paramount has the fifth most subscribers.

Paramount Movies will typically deliver positive cash flow of ~$100MM but was negative ttm in an unusual year for movies. But in any case it is not a growth driver.

Paramount’s overall Weighted Average Cost of Capital (WACC) is 7.2% and their Return on Invested Capital (ROIC) is 4.49%, so they are not creating value now. In order to get to an attractive economic state, they would want to target a ROIC closer to 12%. This would require their Operating Income to increase $3.9B from $2.2B to $6.1B (+177%), presumably driven more than 100% by gains at Direct to Customer streaming (since Television is in decline).

In the most recent quarter, Paramount’s Average Revenue per User (ARPU) was $6.18. This is 47% below Netflix’s global ARPU of $11.76. And since Netflix’s number has a larger share of Indian subscribers, a more apples to apples comparison might be to Netflix’s US ARPU which is $16.29. So this is an inexpensive service. Note that Wal-Mart offers discounted access to Paramount+ for $5.41 per month.

Paramount+ is in the second tier of subscription video services in terms of customer stickiness and therefore churn:

For Paramount’s streaming business to break even they would need 12.8MM incremental subscribers (a 20.2% gain from 63.4MM to 76.2MM) or they would have to raise prices 20%, in each case while maintaining today’s cost structure.

To get the streaming business to lift the company as a whole to $6.1B in operating income (holding other divisions stable for now) would require a 63% increase in revenue at Direct to Customer while keeping costs fixed. Just to illustrate the order of magnitude of the required improvement, this would occur if the ARPU at Paramount+ increased from $6.18 to $12.00 (+94%) while the subscriber base grew 27.1MM customers from 63.4 to 90.5 (+43%). (Note that Netflix has 247MM global subscribers.) That is challenging and will not occur soon on the current trajectory or with the current cost structure, but let’s just bear in mind that the win scenario is somewhere north of 90MM subs with a 100% price increase. Obviously, that would require major changes.

What does it tell us when prices are relatively low, churn is high, and viewership is low? It indicates that the actual product, the content, is not exceptional, and the service may lack a coherent identity (i.e. a brand) to customers such that they lack confidence as subscribers that in the future they will get valuable content. Paramount’s results are tier two because, despite getting football through CBS, their selection is tier two. This should be no surprise on a very basic level since, as discussed, Paramount spends $8B per year on their service as a whole (~$4B on content) whereas Netflix spends $17B just on its content, not including marketing or overhead, and Amazon spends ~$8B. That makes it hard to win. As Jeff Bezos once said about Subscription Video on Demand (SVOD), “this is a go big or go home business and I am not a go home kind of guy.”

I think the current course will never deliver the desired results at Paramount. Never.

Paramount either needs to (a) give up and sell its parts or (b) get bigger and better.

OPTION A: GIVE UP AND SELL PARTS

Paramount could shut down Paramount+, sell Paramount Pictures and Pluto, and pay down some debt, slimming down just to the still very profitable TV group, which could be managed for cash as it declines. The value of the company would depend on what multiple the market assigns to this declining asset, but it would not be high and the whole thing would feel like a bit of an ignominious end to a storied company.

OPTION B: GO BIG AND FIND A FRIEND

How can Paramount get itself in position to double prices and yet serve 100MM customers at minimum and become a high ROIC industry leader? It would have to bring a lot more to the table. It would have to be delivering a much bigger service. Unless they are going to raise a lot more from the public markets and grow organically — which is unlikely — that means they have to merge with someone.

NBCU would be very complicated because NBCU would have to spin off NBC. Lionsgate is probably too small to solve the problem. Warner Bros. Discovery is … just right.

Paramount brings Nickelodeon, South Park, the Taylor Sheridan universe, Mission Impossible, Top Gun, Paw Patrol, Transformers, Teenage Mutant Ninja Turtles, Showtime, and all the CBS shows. Warner Bros. brings DC, Harry Potter, HBO, Looney Toons, Hanna Barbera and Cartoon Network, and so many others.

A combined MAX-Paramount+ service could go against Disney-Hulu and Netflix with real growth aspirations and a strong argument for inclusion in any future bundles. Both WBD and Paramount would finally be big enough to aspire to top tier global outcomes.

For Warner Bros., it could probably go either way as between Paramount and NBCU. So it has a fallback.

Onward to 150MM customers at a global ARPU of $12 (revenue: $21.6B)!

QUESTIONS

Would Paramount accept a merger without a share premium?

I would prefer it if PARA shareholders simply merged with WBD without a stock premium realizing that combining the two companies and getting shares in NewCo would be the best thing for them and they don’t need to cripple the company by asking for a huge premium. I think the argument for this arrangement is compelling given the debt load at both companies. Also – a share swap would be tax free.

What is the brand feeling of the combined network?

As I have talked about before, brand is becoming more important in the SVOD business. SVOD per se has lost its novelty and people want to know what they should expect to get if they subscribe to your service in particular. Competitors will increasingly have to have an identity. I think Netflix has made the most progress here developing something in between “the new cable TV” and, when they are feeling more specifically Netflix, something down the street from People Magazine. HBO had a brand but Paramount and MAX do not. I think they have the beginnings of something though with the Sheridan-verse, South Park, Top Gun, and DC. There is something to build on and they should start thinking this through.

What about the Walmart bundle?

Paramount has a bundle deal with Walmart+. I am not sure how much pricing freedom Paramount has in this deal, but right now customers pay $5.41. This needs to be modified substantially over time as price increases are an important lever on the path to having attractive economics. Can it be modified as WBD-Paramount improve their combined service? This is a hard requirement.

Who runs content?

Someone has to run all content at the combined entity or it’s just going to be a nuthouse. You might say this would be David Zaslav but then he is going to be doing content all day and not being the CEO. You might say Casey Bloys but then he is going to be the eye in the sky all day and not developing shows at HBO which is what he is obviously great at. Feels like there is a role to fill here.

Does Paramount Pictures report into Warner Bros. Pictures or do they just try to not step on each other’s toes?

I would guess the latter. But, again, that’s why you will need a head of content.

Who is this bad for?

Of course, this hasn’t happened and it might not happen. Taylor Swift and Travis Kelce might not get married. But if it happens, it is slightly bad for everyone who still does not have a date for the consolidation Prom. NBCU was supposed to be a candidate to tie up with WBD or Paramount. Maybe Lionsgate could have gotten in on the action. Slightly less heat on those companies now, and a bit more competition. Also slightly bad of course for Netflix, Disney and Amazon if WBD and Paramount bring a more formidable competitor to market.

Is it still MAX?

I know we just changed the name but … is the combined service just going to be MAX? I still don’t love it. You know what has high awareness? CBS.

Now do Asia

There are multiple international SVODs that are subscale in their territories but that have great strength in local content that could be important levers in hitting the global subscriber target. These include Hulu Japan, Waave (Korea), TVing (Korea), and Zee TV (India). The new entity needs to get ahead of the curve and merge with these entities before someone else does. Local content is very important, particularly in Asia and these entities know that they need to be part of something bigger and multinational to succeed.

What if HBO was separated from Max?

This could be the worst idea of all time — I mean here we are talking about scaling up! — and I reserve the right to say I was kidding. But. As you think about the brand, does it feel like we are getting pretty far from “It’s not TV, it’s HBO”? From Curb Your Enthusiasm and White Lotus? As if we are trying to combine Red Lobster and Ma Maison? I have talked a few times about the emerging need, as everyone tries to go so popcorn-y and mass market, indeed “so CBS,” for a “new HBO” that just serves the earlier purpose of HBO, to deliver higher end programming to customers who like that (and they found there were 30 or 40 million Americans who liked that very much). I have been thinking of this as some combination of HBO and A24 with upscale series and indie films. Of course you can have all of this in MAX, but is it possible that ultimately HBO and Showtime will not be driving very much of the subscriber base in the combined MAX and might be getting a bit lost? Could it be value maximizing to break out HBO and Showtime into its own HBO network (that could be bundled with MAX)? Maybe a bad idea but I would like to see the numbers.

Happy Holidays everyone!

Roy Price was an executive at Amazon.com for 13 years, where he founded Amazon Video and Studios. He developed 16 patented technologies. His shows have won 14 Best Series Emmys and Globes. He was formerly at McKinsey & Co. and The Walt Disney Co. He graduated from Harvard College in 1989.

Smart read. Numbers and market dynamics look compelling. Get it done and merge or die slowly ( at first then all of a sudden) as to who runs content? That easy, you Roy! Put your hand up mate. Best to all for festive season. Cheers.

How did you calculate Paramount+ ARPU?

For instance, for Q1/2024 I found (https://ir.paramount.com/static-files/f079b3ed-878b-4b7e-9906-cd825853067f) revenue of 1459 usd and 71,2 subs, does that mean they have ARPU 20,49?