Keynes said that “in the long term we are all dead.” Well. Here we are in Paramount’s long term, in years that in various Philippe Dauman-era Viacom projections from the past, were no doubt “out years,” far beyond some distant “terminal value” date, after which all mistakes ceased to matter.

And yet here we all are. Not dead. Whatever mistakes were made in the past, the bill for them has arrived now. And everyone at the table is looking at each other seeing who might reach for their wallet.

Much has been written about Paramount, which is, suffice to say, in a tumultuous and unpredictable situation. I will not try to speculate on anything unknowable here but let’s identify some key risks and opportunities.

The Facts

The business situation is this, in brief. (If you’re fully up to date with the situation, you can just skip to Analysis, below.)

All Paramount is divided into three parts.

CBS and the cable networks

Paramount Pictures

Paramount+

Shari Redstone controls Paramount Global through a company called National Amusements (NA). NA controls ~70% of the voting power (but much less of the stock) of Paramount Global.

CBS and the cable networks throw off generous cash flows (~$5B per year) but are shrinking. The primary need for the company is to replace this broadcast/cable cash flow. Movie department earnings fluctuate (this past quarter was zero), but can’t seriously aspire to get above, say, $300MM max, so at the end of the day they just don’t matter that much one way or the other. Film is currently 8% of corporate revenues.

If anything is going to make this company exciting again, it has to be the streaming service. The service is well distributed. It has 71MM subscribers. It is part of Walmart+. But its average price is very low (~$7.25 vs Netflix’s $16.64) and therefore it still is delivering negative cash flow. I think it is reasonable to believe that their low ARPU is a consequence of their only average content, which means that people sign up through Amazon, Walmart, etc. and not by going direct to Paramount.com. (To me, this indicates a less passionate tier of demand.)

Two credible parties have expressed interest in taking over Paramount:

The early front runner was a group led by David Ellison and funded by Redbird (Gerry Cardinale), KKR and Larry Ellison.

A competing bid came in from Apollo and Sony, acting as a team, for all Paramount shares.

The Ellison team was given an exclusive negotiating period but it expired without a deal. Redstone is known to disfavor the Apollo offer.

If NA and Paramount choose to reject both of these offers, there is the third option of going alone, in which case they have three heads of divisions now essentially reporting to Redstone who could collectively be a sort of “3-eo”. At the recent Milken conference, Jeffrey Katzenberg suggested to Matt Belloni that this was a likely outcome. The trio are:

Brian Robbins, who has run Paramount Pictures since 2021, before which he was running Nickelodeon and Nickelodeon Movies.

George Cheeks, who is a longtime CBS executive.

Chris McCarthy, who ran programming at Paramount’s cable networks before getting some recent exposure to Showtime.

In terms of strengths and weaknesses, this group has lots of traditional TV experience, much less experience with subscription video, and no technical background. I don’t mean to be critical here but, objectively, the team is not long on having a transformative or innovative vision for the industry, or what at Amazon we would call Invent and Think Big (two of Amazon’s leadership principles).

Meanwhile, Redstone has never been a major CEO and she may be unlikely to make up for any shortcomings herself.

As summarized by Rich Greenfield, the triumvirate apparently intends to “shutter money-losing businesses overseas, sell non-core assets such as BET, scale back/shutter Paramount+ and shift to a licensing model with an output deal at Max, Paramount+ or Hulu.”

So it appears that all three groups want Paramount to become a classic studio like Sony (and in the Sony deal, literally part of Sony) plus the TV assets.

Analysis

What we all always have to be wary of is the allure of the past. I’ve said before that most people in entertainment would wish away the internet if they could. Here’s the thing though. Subscription video and video on demand are the future. Broadcast and cable are the past. Movies are a small and, financially, only a semi-relevant business. What happens if Paramount is just CBS plus Viacom (the cable networks) plus Paramount Pictures with no Paramount+?

The first year or two would look better in terms of cash flow. Dropping Paramount+ would cut a negative $1B or so off the income statement and the new outbound licensing might send something to the bottom line (although the current licensing to Paramount+ should be recognized as revenue already, perhaps a third party would pay more). So the next 36 months, besides some impairment associated with a Paramount+ wind down, could look good.

But what’s the growth strategy from there?

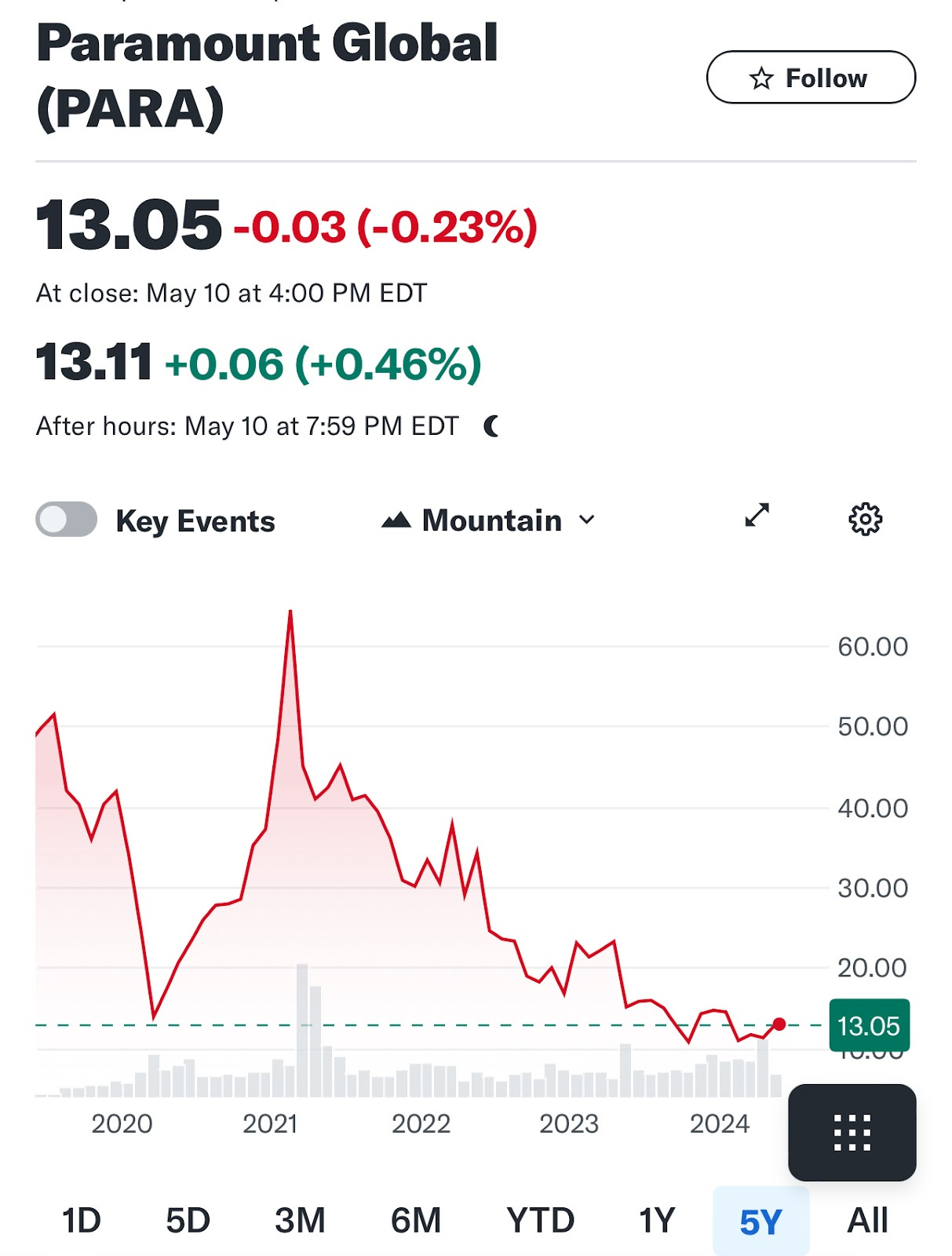

CBS and cable would still be shrinking. Paramount Pictures would be up and down year to year. There is no growth story. The projected cash flows in any discounted cash flow analysis would just be a declining series, which would suggest a low earnings multiple. Would the enterprise value (EV) exceed today’s EV of $23B? Probably, to be honest. Maybe it could go to $35B or so, which would take the stock to $25+.

Consider though that the Return on Invested Capital for studios in the past twenty years has not been awesome. The weighted average cost of capital (WACC) for Paramount is 9.3%. Their recent ROIC has been 0.64%. So as you run more revenue across that particular formula of ROIC-WACC, Paramount destroys value as it grows (this is like if you created an opposite of Amazon). Now, you might say that that ROIC includes negative earnings from Paramount+ and it does not include the projected incremental outbound licensing available once Paramount+ is shut down. True. So what would be the ROIC after the improvements? Would they beat 9.3%? (Disney’s ROIC IS <2%). If you don’t beat your WACC, you’re not creating value as you grow. Suffice to say that I have concerns.

A few more factors/concerns.

Redstone is 70 and has never been a major media or tech exec. If she’s the CEO, I am thinking this is more like an Exec Chairman style CEO but in any case there is no reason to expect a bold era of innovative media leadership. If Redstone is more of a Chairman, one might have concerns about three co-CEOs. It sounds like no one is planning to leave their current role and instead they would share fractional ownership of the CEO role. Who is going to put forward major initiatives that require tradeoffs amongst the divisions? Who do teams meet with if they have to review plans for the next fiscal year and propose disruptive initiatives? To whom do major c-suite officers like the General Counsel and CFO report? All three co-CEOs? Do they meet in one meeting or serially and individually? Who is responsible for identifying new opportunities and jumping on them? Who owns the augmented reality initiative, let’s say? Do all three CEOs sit through the personnel review for every senior exec at the company? When are these co-CEOs doing the non-CEO jobs that they have been doing for the past few years?

With all due respect to Sumner Redstone, in the final years the company’s planning for the future left something to be desired in terms of picking up on the big trends, especially technical trends. Is the described management hierarchy and process ideally suited to avoid that mistake this time?

Finally, if we think long term, one could have concerns about doubling down on the big studio model at this time in general. We’re going to be in a situation where we have a few major streamers and where the economics of the global business do revolve around those entities. How will studios do in this environment? I would say that streamers on the whole will want to reduce, not increase, the percent of content they take in from studios. (Why pay extra?) Moreover, I don’t see what the edge is that will allow these studio entities to defend or grow their return on capital in a competitive environment. So I foresee pressures on the studio model in general.

This does not seem like a fully baked proposal to me.

What is to be Done?

The maximum value of a successful global svod network is much greater than that of a successful studio. Netflix’s market cap is $263B. That ceiling is high. On the other hand, I don’t see how a studio with some declining TV assets ultimately grows too far beyond their current Enterprise Value of $23B. You might say that Paramount is pretty far from being Netflix in the SVOD business – but they’d be a lot farther if they took their 71 million subscribers and sent them packing.

It is important to try to separate the value of the company, the plan and the leadership. So let me ask you a theoretical question. Paramount has a market cap today of $9B (+$14B debt). If Jeff Bezos and Ted Sarandos took the jobs tomorrow as Chairman and CEO of Paramount Global and said they were going to make it contend with Netflix for global SVOD leadership, then how would you value it? You’d believe in the plan? So is this just a team issue?

92% of demand on Paramount+ is for the new original content. This number is in line with competitors except Netflix, which is closer to 50/50. (See Doug Shapiro’s substack for this and other terrific data). So what is stopping Paramount from contending for global leadership? It’s not about the library. It’s about knowing your audience, having a brand and having originals people care about. That takes money — but it doesn’t take a library. Netflix doesn’t have a library. Amazon never had a library. People overvalue libraries and undervalue talent and strategy. Fall Guy came out last weekend. Did the IP set the world on fire? Keep library and IP in perspective. Under the right leadership, Paramount could be a leader.

There is an under-served market out there that Paramount could target. In fact, Paramount’s assets are perfect for it. And it is not fringe — it is the white hot center of American culture. Hollywood has not been serving key genres (especially comedy) and is not laser focused on delivering great content. It has been distracted by politics and has not been doing a great job for regular folks in the middle of the country. So that should be Paramount’s audience. And starting with CBS, South Park and Yellowstone, they have a great base to build on. I have discussed the audience targeting opportunity here and elsewhere.

Do you think this is impossible because it would imply that KKR, Apollo and all these Hollywood poobah’s are incorrect about the best strategy for Paramount? Really? They have all been incorrect for 20 years. It is not only entirely possible that the Hollywood consensus can be wrong, it’s quite reliable! Hollywood hasn’t called its own tune in terms of innovation and its path forward since the introduction of Blu-Ray. And when was the last brilliant private equity investment in entertainment in the U.S.?

Everyone needs to set their sights on the longer term (5+ years). Paramount should back a single leader and commit to a long term, differentiated SVOD strategy, which is their only opportunity to create very substantial value. To do so, they need one of two things. Either (a) they need the leadership to execute on that. Or (b) they need to merge with a strong ally in SVOD. This could involve re-examining the opportunity of Warner Bros Discovery.

Innovation, strategy and leadership are everything. They are the real value unlock. I don’t see them in the existing plans.

Roy Price was an executive at Amazon.com for 13 years, where he founded Amazon Video and Studios. He developed 16 patented technologies. His shows have won 14 Best Series Emmys and Globes. He was formerly at McKinsey & Co. and The Walt Disney Co. He graduated from Harvard College in 1989.

“It’s the white hot centre of America culture”

That should be on the lips of every CEO in every Studio, who ever grabs it will survive.

leave Netflix to be all thing to all people which will get harder as the years go on.

They should hire someone smart and innovative with experience... I vote you!