2022 State of Media Year End Thoughts

Do you find it odd how mainstream media Hollywood podcasts generally take the tone that everything is fine? Few companies are making money, tons of people are getting laid off, no one is getting backend, and many important shows and movies aren’t landing with audiences.

What exactly is fine?

The 10 biggest business issues in Hollywood:

Interest rates are up! No one cares about your imaginary earnings in year ten. Investors want profits now. Shift from growth to profitability!

The rapid decline of pay tv (66% of homes now)

The apparent saturation of SVOD at least in the most lucrative markets

The still bad state of theatrical (despite Top Gun, -34% vs 2019)

The growth of TikTok and YouTube

The revolution at Twitter

The rise of FAST (free streaming, like Tubi or Pluto) services

The apparent death of the movie star

What will web3 mean for IP owners and content creators?

The birth of AI

In Hollywood, SVOD feels mature and pay tv is shrinking. One thing this is exposing is that, really, the world of cable TV subscriptions plus ads plus ownership in the form of DVD plus a healthy theatrical business was a much better business than just having one subscription to an SVOD service! This is mostly because the old system with price discrimination and windows was able to capture the surplus in the demand curve much better than just a single window and single price. It is arguable that too much value is currently going into the SVOD segment of the value chain.

Another self-evident issue no one talks about is that the shows and films are not connecting with audiences as they should be and used to. The number of new shows that audiences love has noticeably decreased in the past four years (-53%); meanwhile, the audience’s general connection to Hollywood seems to be diminishing — awards show viewership has fallen off the table 70%+. As Samuel Goldwyn said, “Include me out.”

Although Netflix did just premiere “Wednesday,” which has been well received and got an 8.5 on IMDb, otherwise Netflix’s new series seem to have lost their luster (-70%). Despite riding on older series such as The Crown and Stranger Things, I predicted in late 2021 that they would soon stop growing in the US. They have.

Disney has also seen a sharp downturn in its objective quality metrics. Marvel used to be a lock for an A CinemaScore but three of its last four films have been B/B+ and She Hulk and Ms. Marvel got 5.2 and 6.2 on IMDb. That must be disconcerting. Strange World has grossed $21MM in the US and got a 4.7 on IMDb! (That’s the lowest score I have ever seen.) Lightyear got an IMDb 6.0 and grossed $226MM worldwide. Not strong.

This is not just an art issue, it is a business issue. As Hollywood’s quality has (objectively) declined, so has growth, and so has cash flow. This is like content inflation — we’re technically getting the same amount of content. It just isn’t worth as much. And customers don’t like it. We need ultrasound content.

The problem is not that a couple tiny films like Bros bombed but that many of the big bets bombed. That’s like a standoff between the execs and the audience.

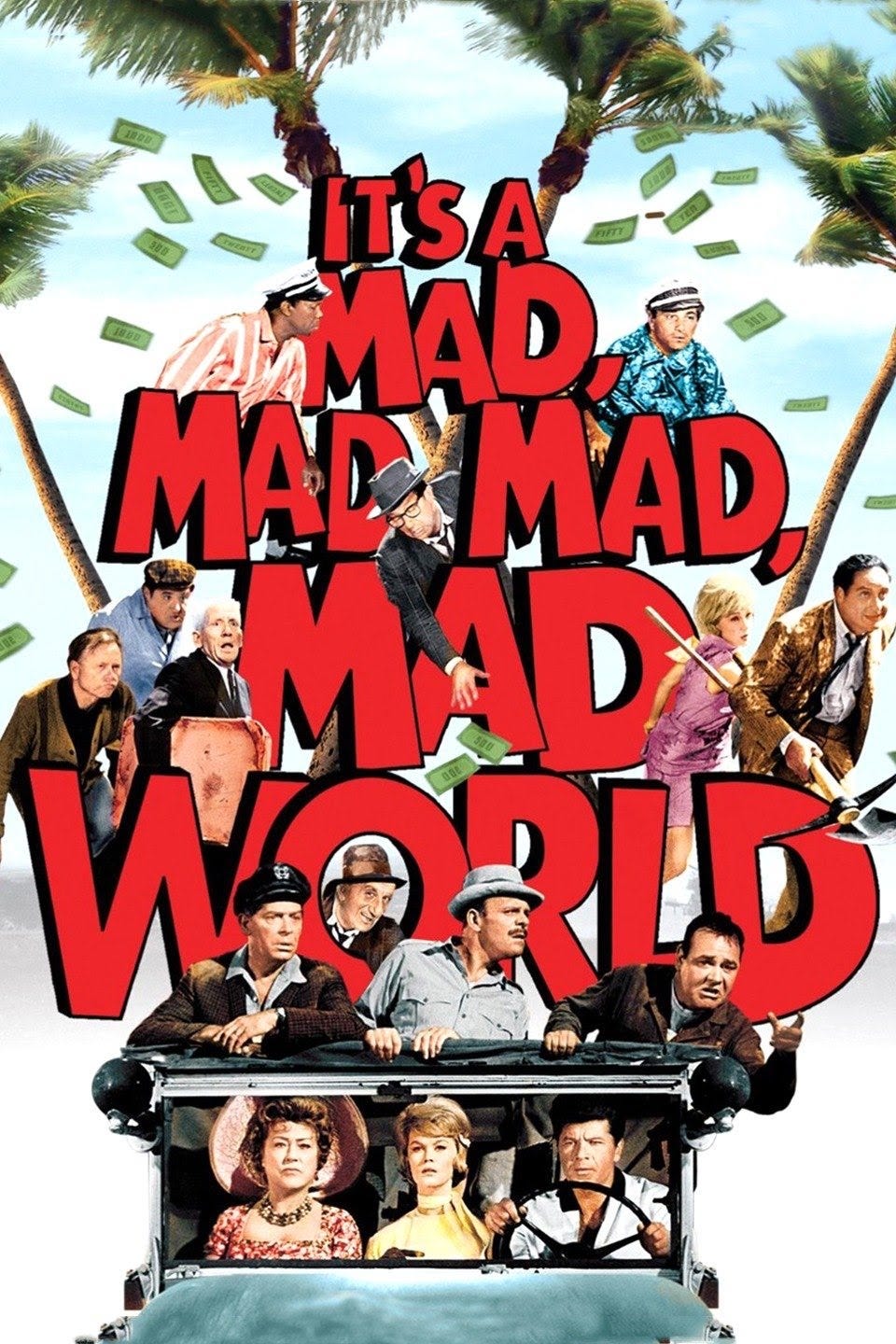

We can debate what the broader problem is, and I think there are multiple issues, but primarily it’s a choice. People are either bad at being executives (and producers, etc.) or they are deliberately making quirky choices. You have to be pretty removed from the Hollywood development world not to understand that there has been a major shift in what Hollywood is willing to make, a conscious movement away from the audience — away from comedy certainly, away from material that is too “smart” (“elite”), and away from, let’s say, things like Top Gun and Yellowstone that feel red state-ish. Paramount is the outlier for the moment but I’m not sure whether that’s intentional or if they stumbled into it. Let’s just say it — it’s a woke, woke, woke, woke world experiment. Top Gun, House of Dragons, and Yellowstone defied the odds and got made (requiring huge stars or properties to do so) and became the hits of the year. They demonstrated that there is still tremendous demand — even theatrical demand! — for fairly traditional but very high quality entertainment.

On the tech side, AI is going to be important. The thing Hollywood people sometimes don’t get is that the first time you meet a tech product it comes in the form of a puppy. But it will grow and get bigger and better. And ChatGPT, Dall-E and MidJourney are already impressive. It is time to think about how these can be put to use designing characters, backgrounds and stories.

Company Comments

I expect Twitter to expand more aggressively into other media. It will be more of a competitor to YouTube and, like WeChat in China, a bigger player in media in general. This has a lot of potential. The slow pace of feature development pre-acquisition will really accelerate.

China has been a disappointment for Hollywood but you can still invest in their domestic business. IQIYI is the #1 SVOD service in China. Their stock is up 50% in the last month and while they are flat on subs, their profitability is improving and their cash flow is positive. Iqiyi has had some tough times and China can be a dodgy place to invest but if they’re getting on track, they could leverage a strong position in a big market for a long time.

AMC Networks. No one is more stuck to the sinking ship of cable TV than AMC and unfortunately they are starting to put out death spiral vibes. Their third CEO in the past year just left, they’re taking a 20% RIF and the smaller their cable footprint gets, the smaller their budgets get and the less they can do to make their networks appealing. Oh, and Walking Dead just ended. Something amazing has to happen here. I think their SVOD package is too complex with AMC and Sundance and Shudder each being its own service. They have to be combined and I think there should just be one brand. You don’t have the budget to make three great things. At least make one. Feels like a make or break year for AMC. Is it a short?

DIS has a forward looking p/e of 23.8 vs S&P 19.9. DIS+ growth has been strong. 44.5MM subs in the US + 49.2MM ex US. Hotstar has 58.4MM subs in India. Hulu has 47MM subs. DIS+ CF very negative.

Disney’s programming strength is Star Wars television. Mandalorian brought Star Wars back to life. Disney really should give Jon Favreau a billion dollars as thanks for that.

Concerns mostly discussed above but I would also note that the Star Wars movie franchise seems dead and India is 37% of their subscribers and they just lost cricket. That’s a big deal.

The question Disney has to ask is: do we have a programming issue or just some bad luck?

To be honest, it feels like there are more questions than answers here right now.

NFLX wants to emphasize that they shd be judged by profit and revenue from now on, not subs, which is to say that they have more or less saturated the market and now the focus is on ARPU and making money. TTM cash flow is +$1.2B. Their US subs were down (Q1) and down (Q2) and then most recently (Q3) ~flat. Dahmer was popular and stalwarts like The Crown still perform but the programming factory is not what it used to be and key metrics such as visits per month are said to have been flashing yellow. But one advantage NFLX has is that they have so much stuff (British Bake Off is popular) that people just think of NFLX as “basic cable” now. Cuts down on churn. The main thing that will change the NFLX story in the next year and could create some upside surprise is ads. Downside surprises would be programming and churn related, i.e. if they underperform and customers leave. Feels like there is more downside than upside surprise potential here right now.

(Note btw that off-the-radar Nexstar’s cash flow is $1.5B, 25% more than Netflix. Nexstar is the biggest local broadcaster in the US. They have a 40% EBITDA margin and a p/e of 7. They plan to grow digitally and leverage their spectrum into new businesses. Where will they invest their cash flow?)

Warner Bros — Best programming team in the industry at HBO. Now they have a great team at DC Films. Warner Bros Pictures has a strong team in DeLuca and Abdy. I feel good about Warner Bros. I think they are also taking a sensible approach by not putting all their content in the HBO+ bucket.

Paramount. Paramount has two of the biggest bangers in TV — Yellowstone and Tulsa King. Taylor Sheridan has been a godsend. Par still seems too small though and the rest of the company is like a big version of AMC. Can Par+ combine with Peacock? Peacock is small, new and not growing. It’s an afterthought at Comcast, which really sells broadband.

The trouble with both Peacock and Paramount is they have no brand. There is no reason to subscribe to Paramount and Peacock except to churn across specific shows. They have to assume that 100% of their customers already have Netflix. Netflix already offers “a ton o’ TV” so as a competitor you have to offer something specific. Like … Disney. Netflix doesn’t offer Disney. Only Disney offers Disney. Disney has a boutique strategy. Netflix has a Wal-Mart (we have everything) strategy. Paramount and Peacock have Wal-Mart strategies in that their shows are interchangeable and have no sense of brand identity. But they have a small selection. So they really have … a K-Mart strategy. K-Mart didn’t work out. Either get bigger or get more specific. Paramount should really lean into the Taylor Sheridan universe plus Top Gun, Mission Impossible and South Park and build everything around that. Anything off brand can be licensed to someone else.

What media company really has a growth path ahead of it? WBD could outperform. LGF could get acquired. DIS, PARA and NFLX have a lot of risk. TWTR has a growth plan but you can’t invest in it. To be clear, no one here has a revolutionary tech-style growth plan or trajectory.

Opportunities

Four new things I think could work.

OPPORTUNITY 1: LOCAL LANGUAGE SVOD

Hulu Japan, Abema (Japan), Waave (Korea), Sony Liv (India), Viu (Asia), Viacom 18 (India) and MD Pictures (Indonesia) —

There are numerous SVOD services, particularly in Asia, that mostly serve just one country (often affiliated with a broadcaster) and which have a strength in local programming. To become strong competitors, they need originals which means they need more scale. They have to amortize originals over a larger footprint. These entities need to merge with each other to form a local language powerhouse. Yes I think their originals would travel. Japanese anime and Korean shows already travel. The reason Japanese live action shows don’t travel is that they’re made for $300K an hour.

This united local language service could merge with a U.S. entity (LGF?) to get some US flow. They wouldn’t push Netflix into the sea, but they’d hold their own for sure. Right now they’re hanging in there but not really competitive.

OPPORTUNITY 2: US SVOD?

SVOD and FAST look crowded. But are they? Back to that comedy/Top Gun/Yellowstone issue. If every restaurant in town goes vegan, is the market crowded? What happens if we open a steakhouse? If every network is too woke for comedy and too woke for Top Gun, and presumably too woke for Passion of the Christ ($612MM USBO), and somehow too woke for anything like The Sopranos, The Shield, Mad Men or probably South Park, so if every network is vying to be the #1 network for Teen Vogue readers and residents of Silver Lake, is that not an opportunity? What happens if you create a network for Cincinnati and Texas and Florida and London, Tokyo and Munich? That’s a lot of people. Could this be a path for Par+ or even HBO? Maybe. Doubt they’ll take it though. Feels like an opportunity for a new brand. This is actually what Nexstar should do, building on News Nation (formerly WGN). This is specific and no one else is doing it.

OPPORTUNITY 3: INDIE

Perhaps the most troubled segment in the US is indie film. Despite the great success of Everything Everywhere, which was great, it’s a tough market now. Some key theaters have disappeared and the specialty customer overlaps heavily with the most mask-wearing, stay at home, grey man bun, NYT-subscribing, Westside Pavilion audience who aren’t back at theaters yet. The financing marketplace pre-festival is very weak. Low viewership of the Oscars and non-existent Globes has diminished the value of winning awards, and Academy rules have made the space even more challenging.

I could argue that these films aren’t optimally handled by the biggest streamers. They require a sophisticated, bespoke approach to the festival market and to theatrical. There is an audience out there for the next great specialty film but this category is becoming less important to the major streamers as they scale up. A brand can be created. A24 already has a brand in this space. Maybe that could be the core brand. I think this is big enough to pursue. It could be led by or include Criterion, Mubi, and/or A24. Could this be the same brand as the Texas/Florida brand? This brand could include a lot of elevated genre that might please both audiences, but probably not.

OPPORTUNITY 4: CRYPTO & FINANCING

I have discussed this elsewhere but crypto, despite a downturn (Eth is down 74% from its all time high — almost as much as Snap and Docusign), is an important new phenomenon that unlocks capital and a 24/7 global market for trading in IP. These can be securitized to enhance financing opportunities for content creators, allowing creators to get financing while retaining more control and ownership of their work. This is already happening with NFTs and I expect will be available to other media types in 2023. The process of financing a movie or any media project is currently long and laborious. It should be online, digital, and fast. You could combine this usefully with the indie brand/SVOD idea and that would really help the indie film space.

In the future, financing your film or TV show will be much more like Hollywood Stock Exchange than like 52 meetings at various film markets.

Looking forward to an exciting year. Let’s hope there is more good news than in 2022!